|

| Source |

What's your pipe dream? That dream that you go back to after a bad day or feeling a little trapped in your cubicle on Monday morning.

Mine is easy. I want to live in a different country every few months and work on personal projects -- ranging from 30 day challenges to art projects to reading big books to creating apps to learning new skills. I have all these things I want to do and learn, but feel like I never have quite enough time to really "get good" at my hobbies.

So, what's my current solution? I've been trying to devote a LOT of time and effort to doing interesting things outside of work. It's working, but I want more.

That's why I have a long-term vision of extreme early retirement. No, I don't want to be a housewife. I also don't want to act like a retiree (no Carnival cruises in my future). Instead, I want the freedom to choose what I devote my time to without worrying about my very basic needs being met. I'd still work, but it'd be on my own things, and at some point, hopefully I'd figure out how to make some money off my projects.

How do you do this? Well, the blog, Early Retirement Extreme (yes, that's the real name), tells the story of a young man who previously made a modest salary of $40K was able to partially retire by age 30 and fully retire by age 33. No, he wasn't a trust fund kid. He just learned the basic principles of investment and cash flow. I've used his diagrams below to explain further.

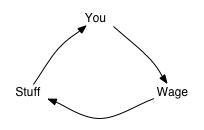

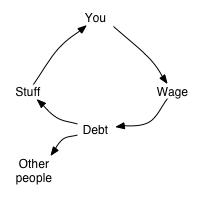

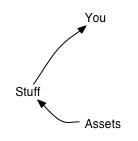

Most people do something like this. They have a job and use that money to buy stuff, or in some cases, they use debt to buy more than they make and then pay interest fees.

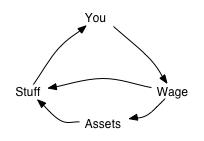

More financially savvy people know it's important to save and invest. They know it's important to use their wages to buy things like property or equities, which can eventually make a profit in order to buy stuff. This is where I am today.

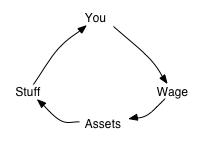

But, the ultimate place to be is this. You want to feed all of your wages into your assets, and then use the profit from your assets to buy stuff. At some point, your assets should be able to generate enough profit to cover all of your purchases (or, at least your basic ones and then you can find other ways to make money for "fun stuff").

Getting to this place is MUCH easier if you move to a less expensive area (re: not Singapore); hence, why my "vision" includes living in different locations, ranging from a cabin in the woods to a beach in Thailand to a small town in Latin America.

Last month, I got a financial advisor onboard, and I think I could get to this place in 2-3 years. Maybe I'll never actually go through with this pipe dream (there's a lot of perks that come with working a normal job), but there's something very freeing about the idea that *I could*.