|

| Source |

What's your pipe dream? That dream that you go back to after a bad day or feeling a little trapped in your cubicle on Monday morning.

Mine is easy. I want to live in a different country every few months and work on personal projects -- ranging from 30 day challenges to art projects to reading big books to creating apps to learning new skills. I have all these things I want to do and learn, but feel like I never have quite enough time to really "get good" at my hobbies.

So, what's my current solution? I've been trying to devote a LOT of time and effort to doing interesting things outside of work. It's working, but I want more.

That's why I have a long-term vision of extreme early retirement. No, I don't want to be a housewife. I also don't want to act like a retiree (no Carnival cruises in my future). Instead, I want the freedom to choose what I devote my time to without worrying about my very basic needs being met. I'd still work, but it'd be on my own things, and at some point, hopefully I'd figure out how to make some money off my projects.

How do you do this? Well, the blog, Early Retirement Extreme (yes, that's the real name), tells the story of a young man who previously made a modest salary of $40K was able to partially retire by age 30 and fully retire by age 33. No, he wasn't a trust fund kid. He just learned the basic principles of investment and cash flow. I've used his diagrams below to explain further.

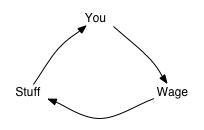

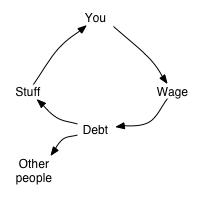

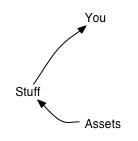

Most people do something like this. They have a job and use that money to buy stuff, or in some cases, they use debt to buy more than they make and then pay interest fees.

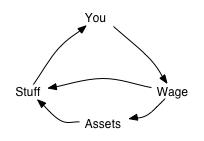

More financially savvy people know it's important to save and invest. They know it's important to use their wages to buy things like property or equities, which can eventually make a profit in order to buy stuff. This is where I am today.

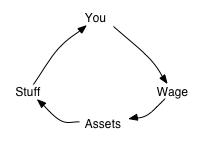

But, the ultimate place to be is this. You want to feed all of your wages into your assets, and then use the profit from your assets to buy stuff. At some point, your assets should be able to generate enough profit to cover all of your purchases (or, at least your basic ones and then you can find other ways to make money for "fun stuff").

Getting to this place is MUCH easier if you move to a less expensive area (re: not Singapore); hence, why my "vision" includes living in different locations, ranging from a cabin in the woods to a beach in Thailand to a small town in Latin America.

Last month, I got a financial advisor onboard, and I think I could get to this place in 2-3 years. Maybe I'll never actually go through with this pipe dream (there's a lot of perks that come with working a normal job), but there's something very freeing about the idea that *I could*.

I stopped spreading enthusiasm about ERE when I realized that most people seem to be put off by the idea of owning their own time. Or maybe just by the sacrifice it takes now for the benefit of an impalpable future (the delayed gratification delio me-thinks).

ReplyDeleteAnyway, it is really refreshing to read that somebody has wrapped her mind around it and seen the light!

A tip on the journey I realized too late: Channel your current "freedom to choose what I devote my time to" towards math (even the ugly stuff), investing, finance and be careful with the advisor.

Consider that everybody who hands you second hand advice is mostly concerned with himself. Never wondered why most of the mutual funds just barely follow the market and the others are private? - It’s because advisors are rather save than wrong.

Also, don't be afraid to take risk and realize losses especially early on. If you manage to compound just a few pipes more in the long run that'll translate into substantially more "freedom to choose what I devote my time to".

PS Don't forget that your "assets" don't just produce interest that buys you stuff but instead that this is shaved off from the debt-cattle while you transition from being one factor of production -> Labour, to a provider of another one -> Capital.

- There is a bitter taste to it.

Good advice, Martin! Agree I need to do more research on my own.

DeleteMy advisor is highly recommended from some close friends that have been using him for several years, and he won't make a buy until we've discussed the investment. I'll take your advice and do my own due diligence before I OK investments.

I agree on the "several" pipes -- right now, I've been investing my money into 3 different business ideas. Depending on how those go, I'll continue. I mean, if 1 out of 10 works well, that's a good thing, right? ;) And, it's okay if I take losses on the ones that don't work. I mean, you have to fail to get to something good for the most part in life.

Can you explain the PS a bit more? Do you mean capital gains tax?

No No, it’s not about capital gains tax, that’s an entirely different can of worms. The PS part is more the philosophical conundrum that is only of concern in case your parents ingrained those vicious working class values into you.

ReplyDeleteThe problem is that in order to get ahead and life of your investment you need to grow your stash faster than the economy does. It’s got to be squeezed out somewhere and somebody is always at the other end of any deal. This isn't really visible in your vanilla mortgage-backed security that you diversify your portfolio with.

In simple terms think about a car loan, somebody is buying a car he can't afford and you lent the cash. You take the interest because he could default and people would argue that this is your reward for covering the risk. The common reaction is rather cynical and boils down to disregard the loan-taker as stupid. I have seen that this take makes people miserable as it forces you to take on a less respectful menschenbild because if you get ahead the other side must suck.

So instead I like to think of the loan-taker and me as a team, he allows me to spend my time more purposefully and in return I have an obligation to use this time for something greater than myself.

- “I want the freedom to choose what I devote my time to without worrying about my very basic needs being met. I'd still work, but it'd be on my own things” that would also help other people to realize their full potential.

It’s still phony but meh, I have a lot of time to ponder left. ;)

As for your investment advisor, would he have talked you into investing in google 10 years ago? Did he advise your friends to stash away a few bitcoins 2 years ago? Most of the time you get some version of the portfolio theory served with a side of Warren-Buffett-wisdom.

- My remark was more a tease geared with Benjamin Graham in mind who said that the really big fortunes have been made by people who packed all their money into one investment they knew supremely well.